Most don’t realize it but being self-employed or a freelancer is less risky than being classically employed. As a full-time employee you have a lot of disadvantages.

- 40-hour weeks

- Income tied to just one employer that can cut you at any point for any reason

- Little leverage in negotiations

Being Self-Employed is Better/Different

Granted it’s scary to take the plunge and may not work out. And it’s slower than getting a full-time job. But if it does, you are in a great position with a strategically built client/customer base.

- Multiple clients – you won’t get fired from all at once (most likely, disability is a concern but same would apply to a full-time employee)

- Leverage – you aren’t tied to just one client or customer so you can more easily walk away. This helps you raise prices faster and dictate the terms of the relationship more

- Ability to experiment – Your clients don’t know each-other and you can set different expectations with each. Maybe you want a vacation but can still work the few hours one client needs to finish a project, just tell the others you are out of the office while you finish a big project. Hard to do that as an employee

Many freelancers view freelancing as temporary and seek out contractor jobs that are essentially like employment but without benefits. Don’t do that! You are a business.

Have multiple clients or charge enough to plan for contracts ending.

How I Budget

A full-time employee only has one source of income. Many recommend they need 3-12 months of income as an emergency fund.

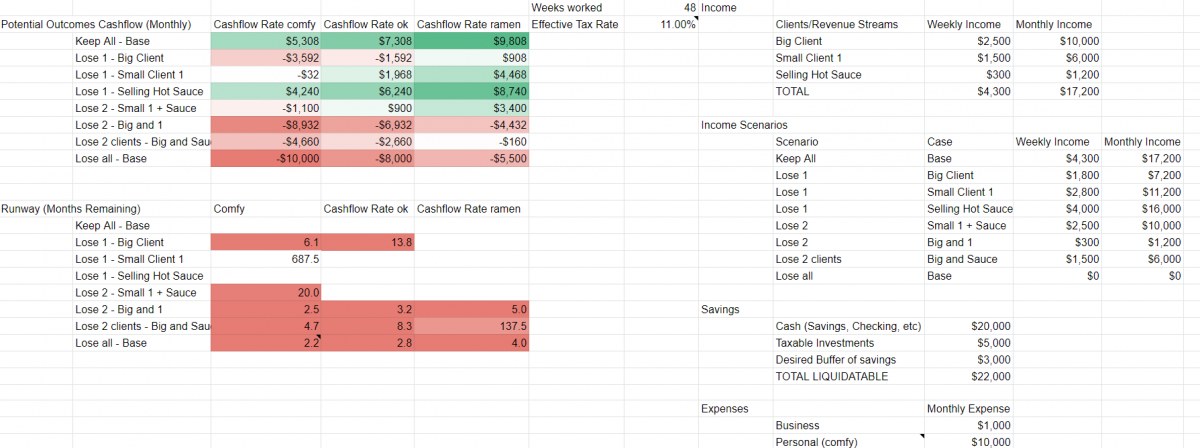

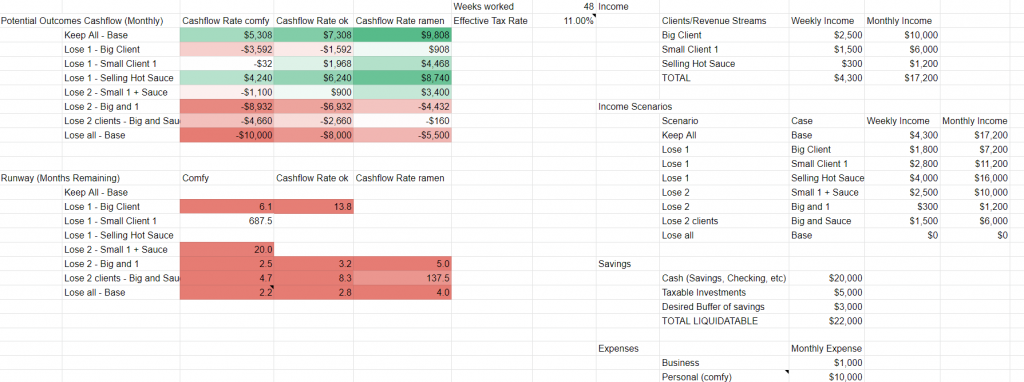

As a self-employed person, you may not need that much. If you feel solid with all your clients maybe 3 months runway from losing one client is sufficient. You can reinvest these savings from the smaller emergency fund to further develop your business.

Check out the Google Sheets spreadsheet below.

I’m always aware of my income if I lose a client or revenue line. This helps me realize how much they matter, or don’t. And where I am.

Maybe an extra $1,000 a month would help me reach a short-term savings goal. Maybe I cannot go to as many fancy restaurants and have much better work life balance.

Or maybe working an extra project would give me 5 months additional runway in starting a new business.

This is essential for freelancers and business owners to understand their business and help them prioritize their budget.

Try It Out!

Take a stab at creating your budget using the template. If you have any questions or want my help, please feel free to set up a meeting with me.

Before implementing it, I would recommend you seek out a personal financial planner to ensure it is right for you.

This is not investment advice and not personal financial advice. Real advice is specific to you and comes from a planner working with you directly to achieve your goals.