Maybe you’re newly engaged, just married, or been at it a while. In any case… Congratulations!!!🍾🍾🍾

Here’s some personal finance tips to set yourself up for success.

What is Marriage Really?

The deep question. What really is marriage?

Symbolically it implies you are serious about being with your partner for the rest of your lives. Till death do us part. But legally it’s a bit more complicated and there are important financial considerations that go along with it.

Taxes

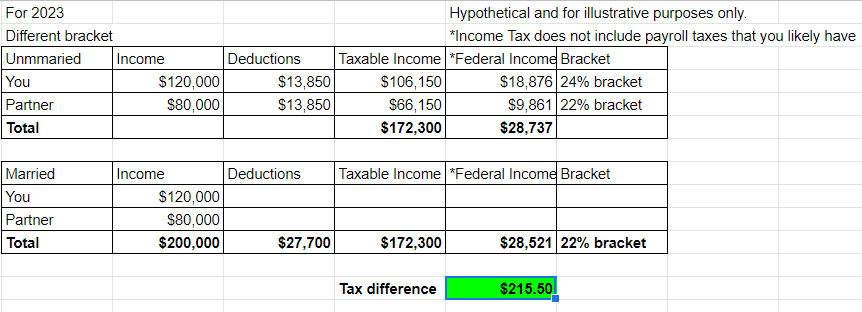

One major change of being married is the ability to use the filing status married filing jointly. Which generally doubles your “standard deduction”.

You also have new tax brackets. These can help if you are in different tax brackets. But may end up hurting you if you both make a lot of money and are in the upper end of the 35% single bracket.

See a few examples in the Google Sheet below.

To decide on how to file, joint or separate, I’d recommend you draft your taxes in whatever tax software you use and compare your tax. Or you can hire me, an Enrolled Agent and tax preparer who has extra tax training. I’ll run the projections for you and can give you advice for your specific circumstances if you have any questions.

Community Property??

Have you ever heard of community property? That roughly means that anything you make or acquire during the marriage is split between you and your spouse.

Most states aren’t community property but where I live, Nevada is one. Look up yours!

For taxes this can make it difficult to file “married filing separately” since your income must be shared as well, which defeats the purpose if one spouse wants to file separately to help with student loan repayment plans.

Community property changes the base rules of the marriage contract. This could have important considerations on whether you decide to do a pre-nup or not. And how you and your spouse want to share or not share your finances.

Should You Get A Pre-Nup?

A pre-nup is essentially creating your own marriage contract. While awkward to talk about, they are useful. As with any contract, it should help both parties understand how finances will be shared and owned in the event of a divorce or death.

Some good reasons to get a pre-nup:

- You both make considerably different amounts of money

- One spouse will invest in the other spouses career

- Inheritance (one spouse wants to contribute to buying a house using their inheritance but get an equitable portion back later if something happens)

- Pre-existing debts (similar to inheritance)

- Adequate consideration for taking care of kids

- A spouse wants to have or has a business that would be hard to split

- You want to make divorce straightforward and fixed to some standard at the time of your marriage (state laws do change)

Before you get married you should get an idea of what that means in your state. I would recommend you do some online research and reach out to a pre-nup attorney to decide whether one makes sense for you and your spouse. A financial planner can help you too but a consultation with a family law attorney is best. Expect to pay at least a couple of hundred dollars.

Even if you do have a pre-nup it might get thrown out too!

An attorney in your state is best for specific knowledge about the validity of a pre/post nup, drafting trusts, and first-hand experience through the legal system on how things can actually work.

It’s best to approach the pre-nup far before the wedding date to give both you and your spouse time to fairly negotiate. You’ll likely be recommended to have separate attorneys, so each party is adequately represented.

Missed the boat or can’t decide? You can also do a post-nup, but seriously… talk to an attorney.

How to Manage Finances?

There are 3 main ways couples split income.

- Separate everything

- Separate with common fund for shared expenses

- Shared everything

As a self-employed person your income progression is different.

If you’re the low earner now, you’d probably like option 3. But what if business takes off and you become the higher earner?

There’s no right or wrong answer here. I’d recommend you talk about it with your spouse and be flexible. Marriage is full of compromise.

Personally, I lean away from option 3. I like the autonomy for “silly” purchases. The $100 in garden seeds I spend per year bewilders my wife.

Want to Buy a House? Plan Now!

Planning on buying a house soon? Get familiar with Fannie Mae rules for self-employed borrowers now.

In general, you want to have 2 years of increasing income. If it is decreasing, they will take the smaller year. And income is not your total revenue from self-employment, it’s your net income after business expenses. A good guideline to check is Fannie Mae’s website. See B3-3.2-01, Underwriting Factors and Documentation for a Self-Employed Borrower (12/14/2022) (fanniemae.com) and speak with a mortgage broker! A “conforming” loan through Fannie Mae will most likely get you the best interest rate but there are other options too.

Kids

Do you want kids? Start a budget because kids are expensive! Even a rough idea is helpful.

Money trouble is a major stressor for couples and can easily lead to divorce. Especially if one spouse is bankrolling your dreams. You may need to re-evaluate how you expect to start your business or consider taking turns helping the other person out. This has the added benefit of forcing to you view your business more seriously, since your spouse will be an investor so to speak.

Bootstrapping and freelancing can be helpful to make ends meet too.

Death and Incapacity

Once you’re married more people depend on you. You should look at all your accounts and ensure they will pass to the right person. Maybe that’s your spouse, maybe your sibling. Or a charity. Look up your beneficiaries on your accounts and make sure they reflect what you want.

You also may want life insurance to provide for your spouse if you pass. Term-life insurance is a good place to start and could be all you need. Or maybe you both aren’t that co-dependent on each other’s jobs so you don’t think you need life insurance until you have kids.

Death Document

Another thing that can be useful is a death document. I keep this “death document” around that tells my wife all my account information, what to do, and general advice. Every year I update it with the latest info.

Closing Thoughts

I hope you this article got you thinking more about marriage and your finances. As a married person myself, I’d recommend you always work on your marriage, I like thinking in terms of love languages. And don’t take each other for granted. Things ebb-and-flow.

Anyways, congratulations on being or being soon to be married!